From Wikipedia, the free encyclopedia

Carlos Fernandez Muriano

Often operational efficiency is also greater with increasing scale, leading to lower variable cost as well.

Economies of scale apply to a variety of organizational and business situations and at various levels, such as a business or manufacturing unit, plant or an entire enterprise. For example, a large manufacturing facility would be expected to have a lower cost per unit of output than a smaller facility, all other factors being equal, while a company with many facilities should have a cost advantage over a competitor with fewer.

Some economies of scale, such as capital cost of manufacturing facilities and friction loss of transportation and industrial equipment, have a physical or engineering basis.

The economic concept dates back to Adam Smith and the idea of obtaining larger production returns through the use of division of labor.[1] Diseconomies of scale are the opposite.

Economies of scale often have limits, such as passing the optimum design point where costs per additional unit begin to increase. Common limits include exceeding the nearby raw material supply, such as wood in the lumber, pulp and paper industry. A common limit for low cost per unit weight commodities is saturating the regional market, thus having to ship product uneconomical distances. Other limits include using energy less efficiently or having a higher defect rate.

Large producers are usually efficient at long runs of a product grade (a commodity) and find it costly to switch grades frequently. They will therefore avoid specialty grades even though they have higher margins. Often smaller (usually older) manufacturing facilities remain viable by changing from commodity grade production to specialty products.[2][3]

Contents

[hide]Overview[edit]

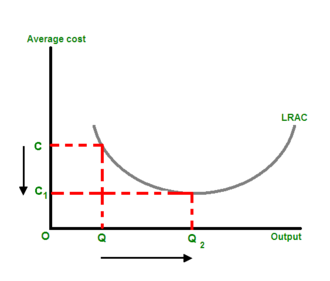

The simple meaning of economies of scale is doing things more efficiently with increasing size or speed of operation.[4] Economies of scale often originate with fixed capital, which is lowered per unit of production as design capacity increases. In wholesale and retail distribution, increasing the speed of operations, such as order fulfillment, lowers the cost of both fixed and working capital. Other common sources of economies of scale are purchasing (bulk buying of materials through long-term contracts), managerial (increasing the specialization of managers), financial (obtaining lower-interest charges when borrowing from banks and having access to a greater range of financial instruments), marketing (spreading the cost of advertising over a greater range of output in media markets), and technological (taking advantage of returns to scale in the production function). Each of these factors reduces the long run average costs (LRAC) of production by shifting the short-run average total cost (SRATC) curve down and to the right.Economies of scale is a practical concept that may explain real world phenomena such as patterns of international trade or the number of firms in a market. The exploitation of economies of scale helps explain why companies grow large in some industries. It is also a justification for free trade policies, since some economies of scale may require a larger market than is possible within a particular country—for example, it would not be efficient for Liechtenstein to have its own car maker, if they only sold to their local market. A lone car maker may be profitable, but even more so if they exported cars to global markets in addition to selling to the local market. Economies of scale also play a role in a "natural monopoly."

The management thinker and translator of the Toyota Production System for service, Professor John Seddon, argues that attempting to create economies by increasing scale is powered by myth in the service sector. Instead, he believes that economies will come from improving the flow of a service, from first receipt of a customer’s demand to the eventual satisfaction of that demand. In trying to manage and reduce unit costs, firms often raise total costs by creating failure demand. Seddon claims that arguments for economy of scale are a mix of a) the plausibly obvious and b) a little hard data, brought together to produce two broad assertions, for which there is little hard factual evidence.[5]

Physical and engineering basis[edit]

Some of the economies of scale recognized in engineering have a physical basis, such as the square-cube law, by which the surface of a vessel increases by the square of the dimensions while the volume increases by the cube. This law has a direct effect on the capital cost of such things as buildings, factories, pipelines, ships and airplanes.[6]In structural engineering, the strength of beams increases with the cube of the thickness.

Drag loss of vehicles like aircraft or ships generally increases less than proportional with increasing cargo volume, although the physical details can be quite complicated. Therefore, making them larger usually results in less fuel consumption per ton of cargo at a given speed.

Heat losses from industrial processes vary per unit of volume for pipes, tanks and other vessels in a relationship somewhat similar to the square-cube law.[7]

Capital and operating cost[edit]

Overall costs of capital projects are known to be subject to economies of scale. A crude estimate is that if the capital cost for a given sized piece of equipment is known, changing the size will change the capital cost by the 0.6 power of the capacity ratio (the point six power rule).[8][9]In estimating capital cost, it typically requires an insignificant amount of labor, and possibly not much more in materials, to install a larger capacity electrical wire or pipe having significantly greater capacity.[10]

The cost of a unit of capacity of many types of equipment, such as electric motors, centrifugal pumps, diesel and gasoline engines, decreases as size increases. Also, the efficiency increases with size.[11]

Crew size and other operating costs for ships, trains and airplanes[edit]

Operating crew size for ships, airplanes, trains, etc., does not increase in direct proportion to capacity.[12] (Operating crew consists of pilots, co-pilots, navigators, etc. and does not include passenger service personnel.) Many aircraft models were significantly lengthened or "stretched" to increase payload.[13]Many manufacturing facilities, especially those making bulk materials like chemicals, refined petroleum products, cement and paper, have labor requirements that are not greatly influenced by changes in plant capacity. This is because labor requirements of automated processes tend to be based on the complexity of the operation rather than production rate, and many manufacturing facilities have nearly the same basic number of processing steps and pieces of equipment, regardless of production capacity.

Economical use of byproducts[edit]

Karl Marx noted that large scale manufacturing allowed economical use of products that would otherwise be waste.[14] Marx cited the chemical industry as an example, which today along with petrochemicals, remains highly dependent on turning various residual reactant streams into salable products. In the pulp and paper industry it is economical to burn bark and fine wood particles to produce process steam and to recover the spent pulping chemicals for conversion back to usable form.Economies of scale and returns to scale[edit]

Economies of scale is related to and can easily be confused with the theoretical economic notion of returns to scale. Where economies of scale refer to a firm's costs, returns to scale describe the relationship between inputs and outputs in a long-run (all inputs variable) production function. A production function has constant returns to scale if increasing all inputs by some proportion results in output increasing by that same proportion. Returns are decreasing if, say, doubling inputs results in less than double the output, and increasing if more than double the output. If a mathematical function is used to represent the production function, and if that production function is homogeneous, returns to scale are represented by the degree of homogeneity of the function. Homegeneous production functions with constant returns to scale are first degree homogeneous, increasing returns to scale are represented by degrees of homogeneity greater than one, and decreasing returns to scale by degrees of homogeneity less than one.

If the firm is a perfect competitor in all input markets, and thus the per-unit prices of all its inputs are unaffected by how much of the inputs the firm purchases, then it can be shown that at a particular level of output, the firm has economies of scale if and only if it has increasing returns to scale, has diseconomies of scale if and only if it has decreasing returns to scale, and has neither economies nor diseconomies of scale if it has constant returns to scale.[15][16][17] In this case, with perfect competition in the output market the long-run equilibrium will involve all firms operating at the minimum point of their long-run average cost curves (i.e., at the borderline between economies and diseconomies of scale).

If, however, the firm is not a perfect competitor in the input markets, then the above conclusions are modified. For example, if there are increasing returns to scale in some range of output levels, but the firm is so big in one or more input markets that increasing its purchases of an input drives up the input's per-unit cost, then the firm could have diseconomies of scale in that range of output levels. Conversely, if the firm is able to get bulk discounts of an input, then it could have economies of scale in some range of output levels even if it has decreasing returns in production in that output range.

The literature assumed that due to the competitive nature of reverse auction, and in order to compensate for lower prices and lower margins, suppliers seek higher volumes to maintain or increase the total revenue. Buyers, in turn, benefit from the lower transaction costs and economies of scale that result from larger volumes. In part as a result, numerous studies have indicated that the procurement volume must be sufficiently high to provide sufficient profits to attract enough suppliers, and provide buyers with enough savings to cover their additional costs.[18]

However, surprisingly enough, Shalev and Asbjornsen found, in their research based on 139 reverse auctions conducted in the public sector by public sector buyers, that the higher auction volume, or economies of scale, did not lead to better success of the auction. They found that Auction volume did not correlate with competition, nor with the number of bidder, suggesting that auction volume does not promote additional competition. They noted, however, that their data included a wide range of products, and the degree of competition in each market varied significantly, and offer that further research on this issue should be conducted to determine whether these findings remain the same when purchasing the same product for both small and high volumes. Keeping competitive factors constant, increasing auction volume may further increase competition.[18]

See also[edit]

- Diseconomy of scale — A region of increasing quantity and increasing long-run average cost.

- Economies of scope

- Ideal firm size

- Long tail

- Mass production

- Network effect

Notes[edit]

- Jump up ^ Sullivan, Arthur; Steven M. Sheffrin (2003). Economics: Principles in Action. Upper Saddle River, NJ: Pearson Prentice Hall. p. 157. ISBN 0-13-063085-3.

- Jump up ^ Manufacture of specialty grades by small scale producers is a common practice in steel, paper and many commodity industries today. See various industry trade publications.

- Jump up ^ Landes, David. S. (1969). The Unbound Prometheus: Technological Change and Industrial Development in Western Europe from 1750 to the Present. Cambridge, New York: Press Syndicate of the University of Cambridge. p. 470. ISBN 0-521-09418-6<Landes describes the problem of new steel mills in late 19th century Britain being too large for the market and unable to economically produce short production runs of specialty grades. The old mills had another advantage in they they were fully amortized.>

- Jump up ^ Chandler Jr., Alfred D. (1993). The Visible Hand: The Management Revolution in American Business. Belknap Press of Harvard University Press. ISBN 978-0674940529<Chandler uses the example of high turn over in distribution>

- Jump up ^ http://s3.amazonaws.com/connected_republic/attachments/33/Why_do_we_believe_in_economy_of_scale.pdf

- Jump up ^ See various estimating guides, such as Means. Also see various engineering economics texts related to plant design and construction, etc.

- Jump up ^ The relationship is rather complex. See engineering texts on heat transfer.

- Jump up ^ Moore, Fredrick T. (May 1959). "Economies of Scale: Some Statistical Evidence". Quarterly Journal of Economics 73 (2): 232–245. doi:10.2307/1883722.

- Jump up ^ In practice, capital cost estimates are prepared from specifications, budget grade vendor pricing for equipment, general arrangement drawings and materials take-offs from the drawings. This information is then used in cost formulas to arrive at a final detailed estimate.

- Jump up ^ See various estimating guides that publish tables of tasks commonly encountered in building trades with estimates of labor hours and costs per hour for the trade, often with regional pricing.

- Jump up ^ See various engineering handbooks and manufacturers data.

- Jump up ^ Rosenberg, Nathan (1982). Inside the Black Box: Technology and Economics. Cambridge, New York: Cambridge University Press. p. 63. ISBN 0-521-27367-6<Specifically mentions ships.>

- Jump up ^ Rosenberg 1982, pp. 127–28

- Jump up ^ Rosenberg, Nathan (1982). Inside the Black Box: Technology and Economics. Cambridge, New York: Cambridge University Press. ISBN 0-521-27367-6.

- Jump up ^ Gelles, Gregory M.; Mitchell, Douglas W. (1996). "Returns to Scale and Economies of Scale: Further Observations". Journal of Economic Education 27 (3): 259–261. JSTOR 1183297.

- Jump up ^ Frisch, R. (1965). Theory of Production. Dordrecht: D. Reidel.

- Jump up ^ Ferguson, C. E. (1969). The Neoclassical Theory of Production & Distribution. London: Cambridge University Press. ISBN 0-521-07453-3.

- ^ Jump up to: a b Shalev, Moshe Eitan; Asbjornsen, Stee (2010). "Electronic Reverse Auctions and the Public Sector – Factors of Success". Journal of Public Procurement 10 (3): 428–452. SSRN 1727409.

References[edit]

- Silvestre, Joaquim (1987). "Economies and Diseconomies of Scale". The New Palgrave: A Dictionary of Economics 2. London: Macmillan. pp. 80–84. ISBN 0-333-37235-2.

External links[edit]

- Economies of Scale Definition by The Linux Information Project (LINFO)

- Economies of Scale by Economics Online

No comments:

Post a Comment